Non-bettors want more sports betting education and more tools to make smart decisions before they make their first wagers.

So concludes a survey commissioned by Los Angeles-based WagerWire and released to California Casinos today.

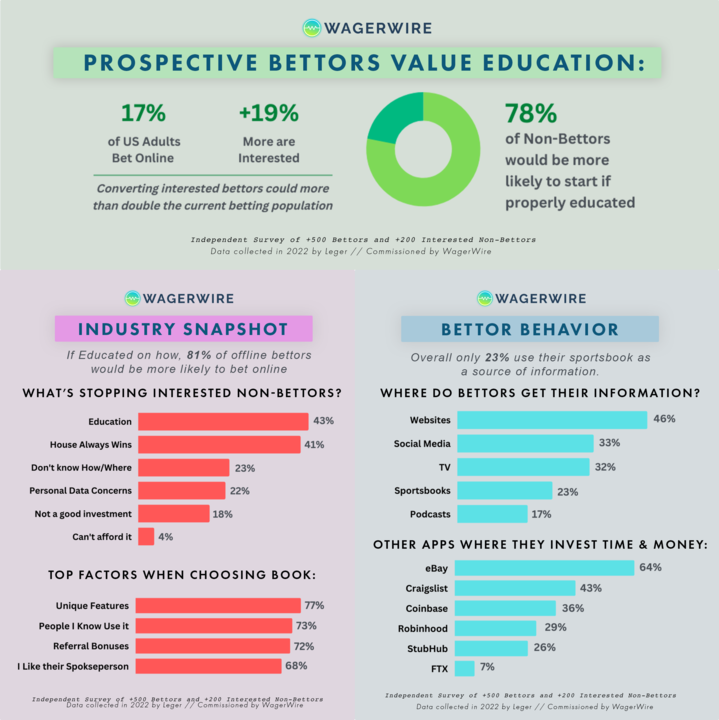

The study, which was conducted by market research and analytics firm Leger, found that 78% of non-bettors said they were more likely to wager on sports if they were properly educated on the process. The survey polled 500 US sports bettors and 200 non-participants from July 8-21.

According to the report, lack of education and understanding of how betting works were the main reasons the non-initiated stayed away. Of the respondents, 43% noted they don’t feel like they know enough about sports betting. And 41% said they weren’t familiar enough with navigating an online sportsbook.

Another 23% said they didn’t know “how or where to bet on sports.”

So, if folks are ever able to legally bet on sports in California, companies may want to invest in some sort of customer education to maximize their monumental California revenues.

What Is WagerWire?

WagerWire, which allows bettors to sell or trade portions of bets made with online sportsbooks, was the first start-up announced in the HPL Digital Sport and Cardinal Sports Capital Accelerator Program. The company added Miami Marlins co-owner Roger Ehrenberg in a second seeding round.

WagerWire co-founder Zach Doctor said his company’s app, which should launch early in 2024, will include educational resources for new bettors in conjunction with the Gaming Society.

ELECTION PRIMER: 28 Questions on Prop 26 vs. Prop 27, 28 Days Before the California Election

“We do think it’s very important,” Doctor told California Casinos. “A lot of people in the industry are just so in it every day that they just don’t really take a step back and realize how new this is to a lot of people, especially just given how fresh sports betting is. It’s definitely something that we’ve seen personally in our experience.

“We’re not industry insiders. We’ve come into this industry to kind of shake things up the cool new idea. And so we see it every day that our friends and families and other people are just thirsty for better materials and content out there.”

Late in 2022, WagerWire announced a partnership with the Wagr sports betting app to collaborate on bettor education in Tennessee.

WagerWire, through future partnerships with online sportsbooks, would serve as a stock exchange of sorts where bettors could buy or sell parts of bets that they or others have made available.

This would suggest a relatively high level of wagering sophistication among its patrons. But Doctor said there remains a knowledge gap across the broader landscape of potential new customers. He’s surprised that sportsbooks haven’t attempted to fill that void as part of what has been an expensive customer-acquisition process since the repeal of the Professional and Amateur Sports Protection Act in 2018.

“Lot of times you jump on these (sportsbook) apps and it just feels like you’re jumping into an Excel spreadsheet of grids of numbers, -110 and +200,” Doctor said. “It’s just not intuitive for new people. And even for people that know what they’re doing, it’s just the math. It isn’t easy to do.

“(Sportsbooks) kind of intentionally obfuscate it. I also think it speaks to a bigger kind of issue, if you will. The sportsbooks don’t really have a huge incentive to educate you. They’re actually kind of hoping that you lose your bets. So there is this kind of inherent conflict there. And I think we come in from an interesting spot where we’re not a sportsbook, so we can actually help drive proper education and really actual quality content.”

IF PROP 27 PASSES … Potential California Sportsbook Promos

WagerWire Backs Prop 27 in California

One day, uninitiated sports bettors in California will be in need of such education. The recent poor polling of both Prop 26 and Prop 27 suggests that day won’t be in 2022 or 2024. But Doctor and his fellow co-founders remain squarely behind Prop 27. It would allow the national operators they hope to sign partnerships with into the state through mobile platforms.

As WagerWire commodifies online bets, the retail model Prop 26 would establish is useless for the California company.

“We would definitely be in favor of 27,” Doctor said. “Look, if 26 passed, we’d probably look at it as a step in the right direction, but we really think to best serve the constituents as well as to just generate the most tax revenue possible, you need to go online because sitting here in LA an hour and a half away from the nearest tribal casino, I can tell you with pretty sure confidence that no one’s going to be driving to Morongo (Casino Resort & Spa) to place their bets when they could still just bet on their bookie’s sites from their couch.”

Doctor, like many Californians, has been inundated by pro and con ad blitzes. He says he remains hopeful that current polling of around 27% percent for Prop 27 can improve. But he deems himself “not super optimistic.”

BINGO! California Tribe Will Offer Sports Betting-Themed, Class II-Compliant Bingo App

With a defeat — Prop 26 is polling woefully, too — the three most populous states, accounting for about 28% of the nation’s population, would remain off the legal sports betting grid. Florida’s sports betting market last a month last November before it was shut down by a lawsuit. Texas legislators meet only in odd-numbered years.

California, with a nation-high of nearly 40 million residents, remains the prize. We’re talking $3 billion in annual revenue. Maybe even more if you believe the California Legislative Analyst’s Office estimates.

“This would be a monster state to unlock,” Doctor said. “When we saw the numbers that New York put up, I think they’re estimating that we would even surpass those. At the same time, as a resident of California, I do think we probably could get better than 10% tax rates and return a little bit more of that to the state for good causes and things like that.

“So maybe when they circle back around, we’ll get a more market tax rate, something like New Jersey’s doing. I think they’re at 20%. Plus, I think as a businessman and as someone who just kind of makes deals week in and week out, I think they should come to the table. I think the tribes and the commercial operators should figure something out where the tribes can maybe get a point of (gross gaming revenue), but then that allows the commercial brands to come in so that the users get a chance to bet with the platforms that really provide the best experience and brand recognition.”

PROP 26 STRATEGY: The Prop 26 Campaign’s New Target? California Card Rooms